36 FD MR VS FHR18

Besides fixed rate home loans, homeowners in Singapore now have another option to consider when refinancing or taking up a new home loan – deposit-based mortgage solutions, besides the usual sibor- or board-based packages. After the introduction of its own 36 FD MR (36-month Fixed Deposit Mortgage Rate) for OCBC home loans last month, there are now two banks offering deposit-based mortgage pegs with DBS being the pioneer. Hence it is not surprising that we now get question from clients – which is better?

Lowest Fixed 2.95% (Min $500k)

As both pegs are based on how much the banks pay for their fixed deposit (36-month for OCBC currently at 0.65, and 18-month for DBS currently at 0.50), essentially they are of the same nature – more stable and less volatile than Sibor rates. It will be difficult and also meaningless to predict which bank will be the first to adjust its peg up when prevailing interest rate rises. We know for sure if liquidity dries up in Singapore banking system following rate hikes in US, at some point all banks even local ones will be hit with higher cost of funds and will inevitably increase their fixed deposit rates. But that should be the last few to go up after sibor and board have moved.

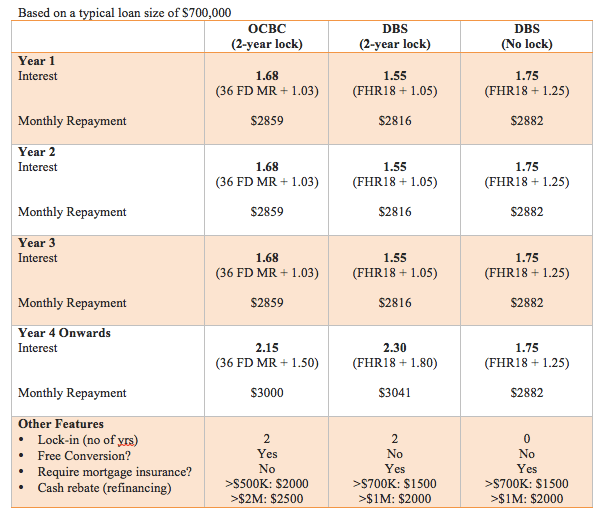

Rather the best way to answer that question is to simply do a comparison based on the overall features of the loan packages which will be more enlightening. So let us put all three packages side by side as illustrated in the table below.

Based on a typical loan size of $700,000 and assuming that rates do not change over the next 4 years (or both banks increase their peg by the same margin), the difference in savings is not much between the two banks if we compare the two similar packages with a 2-year lock. The $43 ($2859 – 2816) savings in terms of monthly repayment (ignoring the effects of amortization) works out to be around $1548 over a 3-year period. However come year 4, DBS has a higher spread of 1.80 versus OCBC’s 1.50 notwithstanding 36 FD MR is by default slightly higher than FHR18, this leads to one paying more on DBS home loan package, ie. $41 x 12 months or $492 in one year which wipes out about a third of the savings on DBS in the first 3 years.

Lowest Fixed 2.95% (Min $500k)

There is still a savings of approximately $1000 in this case however if one factors in the mortgage insurance premium that one has to pay in order to enjoy the slightly lower spreads in the first three years of the loan (+1.05 vs +1.15), then the savings might be reduced to nought depending on one’s age and cover. However for those without mortgage insurance protection, paying for it offers a real tangible benefit (protection so as not to overly burden the property’s beneficiary in event of a claim) so it may still make a lot of sense.

The real winner in our view lies in DBS’s 2nd package which comes with no-lock as it is one of few packages in the market that offers a constant spread all through the entire tenure of the loan; and not a lower spread that often gets reverted to a much higher level after three years, forcing the borrower to look at refinancing options once more. We have already cautioned many times in this blog (even though doing so means less business for us mortgage brokers), refinancing entails not just effort and time, but costs as well in the form of legal and valuation fees and will not work so well for smaller loan quantums.

Lowest Fixed 2.95% (Min $500k)

Should one then go for the no lock package by DBS which naturally comes with a higher spread of 20 basis points (+1.25 vs +1.05) compared to the 2-year lock package? This is a tougher call to make – one needs to look at the possibility of selling away the property in the near term, the ease of refinancing every three years, the need for mortgage insurance, and also the loan quantum involved which will impact how much more interest one needs to pay in first three years, etc.

OCBC has thrown in some sweeteners like a one-time free conversion to any of the prevailing packages within the bank should the OCBC move its 36 FD MR peg during the 2-year lock-in. This is appealing as it offers a safety net for example should the pace of rate hikes be too fast for one’s liking and banks are forced to raise their loan pegs, homeowners can then take advantage of this free conversion to switch to a fixed rate mortgage with OCBC. The bank also offers a slightly more generous legal fee subsidy or cash rebate ($500 more) which could help cover almost the entire legal costs involved in refinancing and that might just tip the scale to OCBC for some. Not to mention a lower qualifying bar for the subsidy/cash rebate requiring a minimum loan size of $500,000.

In conclusion, both banks offer very competitive features on its deposit-based mortgage with each package appealing to different needs in the market place. It has become harder now to choose with a myriad of options available to homeowners and will become even more so when more banks roll out deposit-based mortgage or those pegged to cost of funds instead of the plain vanilla sibor or board packages. We see this as a positive development for the mortgage industry in Singapore and to this end we hope to bring more value add in the analytical work we do for our clients.

Since 2014, MortgageWise.sg has provided thought leadership in the mortgage planning space in Singapore, taking deep dives into the latest trends in the industry, providing useful mortgage tips, and making sense of rate movements. We aim to build trust with clients for longer term partnership and not just do product-pushing for a one-time deal unlike bankers. That’s why we always present “whole-of-market” perspective including packages that banks do not pay us. That’s why many have chosen to refinance home loan with us in the end notwithstanding the sheer number of brokers and agents out there.