Almost 1% Home Loan Is Back!

For those who have missed out on Stanchart’s 1% home loan promotion end of last year, here’s the chance again. Do not miss this.

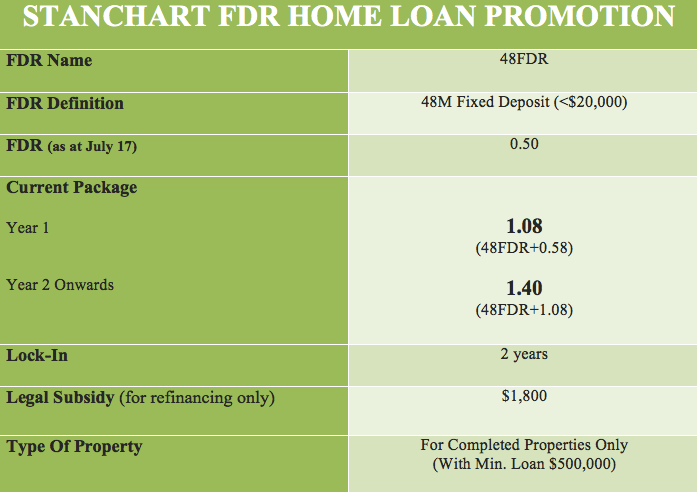

To be precise. It’s 1.08% in the first year this time, but what is more important is that they are keeping their thereafter rate from the second year onwards like before at 1.40% throughout!

Lowest Fixed 2.95% (Min $500k)

At almost 1%, this is as best as it gets for FDR home loans in the market right now, considering how the US Fed has hiked rates three times in a row since last December.

Here’s the Stanchart latest FDR (Fixed Deposit Rate Home Loan) package at a glance (for completed property above $500,000 only):

To understand more about FDR home loans, we have got a very detailed writeup on that which you should refer to. Read it here.

FDR home loans have been all the rage in the last two years, given the fear of rising interest in a slowly recovering US and global economy as US Fed turn more hawkish with forecast of three rate hikes for each of 2017, 2018 and 2019.

However, we have observed that the general view in the market is that SIBOR is not going to suddenly shoot up from the current 1% to 2% overnight. It is most likely going to be a long-drawn process especially in view of the seemingly decoupling of correlation between US federal funds rate and SIBOR in Singapore in the past two years. In fact, the dollar weakened after each subsequent round of rate hikes which is baffling to most analysts. Hence at MortgageWise.sg, even though we have revised our forecast from two to three rate hikes by Fed this year, we are actually lowering our forecast for where we see SIBOR will end the year at from 1.50% range down to 1.25% to 1.30%. We now think the normalizing of rates behavior will only occur after Fed starts to mop up liquidity from the global banking system through sale of its Treasuries and holdings which has swelled its coffer to US$4.5 trillion after three rounds of QE (quantitative easing). This is likely to commence only in the last quarter of 2017 with its effect perhaps felt six months down the road in the second half of 2018.

Lowest Fixed 2.95% (Min $500k)

At 1.08% in the first year, it gives an excellent cushion even if lenders were to start raising FDR in response to a gradually rising SIBOR in the next one year. Speak to our consultants today to see our meticulous tracking of FDR movements over the last three years and, more importantly, how we forecast the likely movements going forward based on our detailed analysis of the lenders’ cost structure.

We have heard from Stanchart this is a limited tranche promotion and will end once they hit the quota. So, act fast! It pays to refinance home loan through us as not only do you receive in-depth and unbiased advice from our very experienced mortgage consultants, you will receive a Tangs voucher from us (based on loan size) and access very exclusive legal fees from our partner law firm(s). Speak to us today!

At MortgageWise.sg, we seek to provide thought leadership in the area of mortgage planning in Singapore, taking deep dive into developments and news on mortgages & helping clients track interest rate movements. We do not just go for one-time business with clients but rather choose to build long trusting relationships by giving truly independent advice to the extent of losing the deal. We strive to become the first-choice mortgage partner for homeowners and the creditable distributor of mortgage products for banks and financial institutions in Singapore.