Why Invest In Property?

This week we will go back to basics and look at the case for real estate investment in Singapore. With seven rounds of cooling measures in place and TDSR (Total Debt Servicing Ratio) here to stay, does it still make sense to invest in property in Singapore? Has the market bottomed out yet? Or is there still further downside?

Based on our general observation in past year, indeed prices of investment-grade properties in CCR (core central region) especially those in district 9/10 seem to have rebounded somewhat but those in outskirts where avalanche of mass market condos are hitting the market remain subdued. Only selective new launches in mass market enjoyed brisk sales usually when unmet demand in areas with no new launches in years are met with the right product pricing. We will look at property prices movement based on our select basket of condos and precincts in the coming weeks.

Lowest Fixed 2.95% (Min $500k)

In this article, we will look at the primary motivation behind property investment (in Singapore) which is still the favoured asset class for Asians especially Chinese in this island city. This is made even more so as other investment classes turned belly up in recent years, from structured deposits, high-yield bonds (O&G), forex like AUD/SGD, even Islandar properties across the Causeway. As investors lose heart in these investments many see the wisdom of going back to basics – investing in a brick-and-mortar asset right here in Singapore where its value will never suddenly plunge to nought unless of course there is war in the country.

What is the primary motivation behind property investment and does it still make sense today? When it comes to the favourite past-time and national passion of almost every working adult Singaporean (perhaps age 30 and above), there are many schools of thoughts (may or may not be true) depending on who you talk to. Here are some of the common themes often bandied around:

- Property prices in Singapore will always go up in the long term, as we are essentially an island – land will always remain a scarce commodity. Property agents love to tell you this – the next peak will be higher than the last, but the next trough will never be lower than the previous low.

- It makes more sense to buy and service your own mortgage than to rent a property and help the landlord pay his mortgage!

- It is always clever to buy an investment property as you can always find a tenant who will help to service your mortgage and pay down the loan for you over time.

- Property is one of the rare few asset class where you can leverage and multiply your return on equity, yet you will not get “margin call” should the market turn against you, so long you can hold and continue to service your monthly repayments promptly

- Property value and rental value is one of the best way to hedge against inflation

- At the worst case scenario when you cannot find a tenant, you can still “move in” to a residential property

Lowest Fixed 2.95% (Min $500k)

Many of these view points do make a lot of sense and appeal to the value and investment philosophy of Asians. The only problem is – if everyone is buying more and more properties for investment but with families are not exactly expanding, how are we going to find all the tenants (be it locals or foreigners) to fill them all up? No wonder we have so many “dark condos” in Singapore’s night scene. Just drive around in the evening. Food for thought.

I like to share in this article what I believe is one of the most important motivation for property investment, be it for own-stay or buy-to-let, but which is often overlooked.

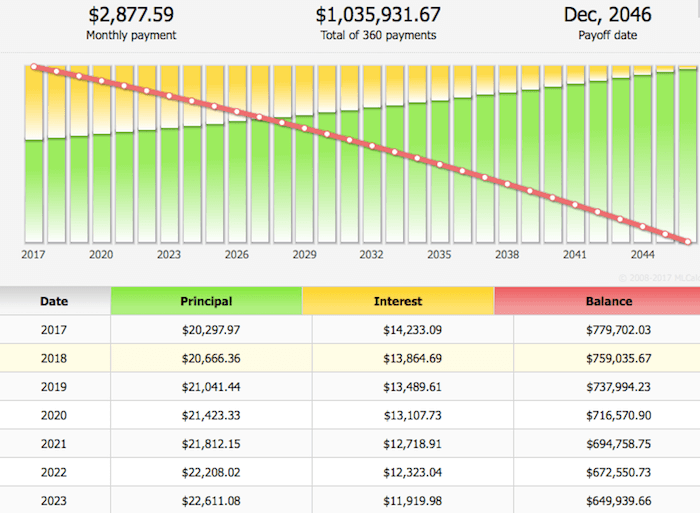

Let’s consider the typical scenario of a young couple 35 years old buying their first condo for own-stay for $1M with a 80% loan at $800,000. At today’s interest rate of 1.8% over 30 years, the monthly repayment works out to $2,877 comprising of interest at $1,200 (42%) and principal repayment at $1,677 (58%) in the first month. Based on standard monthly rest amortization, the interest component will go down slightly every year from the initial 42% of monthly mortgage. In the first year (see below) total interest paid will add up to $14,233.09 which is 41.2% of the total paid $34,531.06.

If we ignore the principal component and look at just the interest per se, the “true costs” or cost of accommodation that the couple is paying to stay in the private property should be just $1,200 a month, a “rent” that is so low they cannot even get a 3-room HDB flat. Assuming that they could not profit from capital appreciation for their stay in this condo over the next 7 years and end up selling it at the same price of $1M (ignore effects of inflation), they would still rake in cash proceeds as the loan has been diligently paid down to $649,939 over the years! Rounding this figure up to $650,000 and ignoring all transaction costs involved, it means they take back their initial 20% of $200,000 plus another $150,000 ($1M less $650,000 less $200,000). And therein lies one of the key motivation of property investment – it is a “forced savings plan” for the couple who would otherwise spend the money every month on other luxury items or going for a few more expensive vacations every year. With a mortgage to service, the priorities would have changed. As the adage goes in personal financial planning – always pay yourself first. In a consumerism-driven world today where every advertiser is constantly coming out with the best and latest features for that luxury continental drive, TV screen, smart phone, etc to entice you, there is certainly great virtue in paying yourself first in the form of a mortgage. And doing all that while enjoying a comfortable stay in a private property for the rental price of maybe a 2-room HDB flat.

Lowest Fixed 2.95% (Min $500k)

Let me also put in 3 caveats. For this forced savings plan to work, one needs to manage 3 things:

1. Buying at the right time

Buying that Singapore condo at right price is important but there is no point getting a bargain but at the wrong point of the property cycle. There are some who held on to a property for 10 years and just manage to breakeven by selling at the same price because they bought at the peak of the property cycle. We have already discussed this – mortgage is a forced savings plan but for the concept of leverage to work, it is still a worthwhile endeavour to try get some capital appreciation at point of exit. And the forced savings plan will not work if you end up selling for a lower price than your entry price.

2. Manage your interest costs, in other words, your costs of accommodation

Understand that there are really two components to a mortgage. The part where you pay yourself first, ie. the principal-reduction, is not a bad thing. The part that you really need to manage is your cost of accommodation, in other words, the interest costs. We all have to pay our cost of accommodation be it rental or owned (even if you buy in full cash, that is your costs of accommodation). Manage ongoing interest costs by having a trusted personal mortgage broker who ensures that your costs of accomodation (starting at $1200 which is 1.8% p.a. in the example above) continues to stay low throughout. Over span of 10 years this works out to be a big expenditure item that could cost as much as your car in Singapore! In the example earlier, over 7 years, total interests add up to $91,653 and that is assuming interest never move at 1.8%. So speak to us today for the best Singapore home loan rates!

Lowest Fixed 2.95% (Min $500k)

3. Buying at the right location

Now the same principles discussed thus far would apply as well in the case of an investment property. If you can find a tenant to pay the “true costs of funds” in this case, as opposed to costs of accommodation, the rest of it you are just paying yourself in another forced savings plan. And here the crux is make sure you can always find a tenant to pay your mortgage or at least the interest component. And if you take heed of that “dark condo” warning earlier, you will do well to remember one of the success formula for investment property purchase – always buy near two things MRT and food. And this is what I know, you can almost never go wrong when the MRT and a shopping mall is right below your residence.

To end, notwithstanding all the cooling measures and TDSR, if you look at property investment be it for own-stay or investment from the perspective of a forced savings plan, and even if you sell it at the same price as your purchase price, it is still very much a worthwhile pursuit.

Since 2014, MortgageWise.sg has provided thought leadership in the mortgage planning space in Singapore, taking deep dives into the latest trends in the industry, providing useful mortgage tips, and making sense of rate movements. We aim to build trust with clients for longer term partnership and not just do product-pushing for a one-time deal unlike bankers. That’s why we always present “whole-of-market” perspective including packages that banks do not pay us. That’s why many have chosen to work with us in the end notwithstanding the sheer number of brokers and agents out there.